We are specialized digital marketing and consultancy services which help in business Start-up, Registration, License and Compliance.

Quick Links

Contact Us

- +91-9599667770

- facsstartup@gmail.com

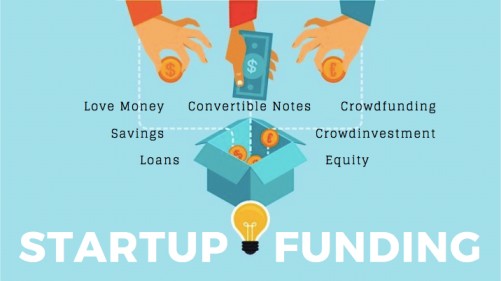

Startup funding, or startup capital, is money that an entrepreneur uses to launch a new business. The money can come from several sources and can be used for hiring employees, renting space, buying inventory or other operating expenses that help a business get started.

Crowdfunding is a method of raising capital through the collective effort of friends, family, customers, and individual investors. This approach taps into the collective efforts of a large pool of individuals — primarily online via social media and crowdfunding platforms — and leverages their networks for greater reach and exposure.

Traditionally, entrepreneurs spend months sifting through their personal networks, vetting potential investors, and spending their own time and money to get in front of them. With crowdfunding, it’s much easier for entrepreneurs to get their opportunity in front of more interested parties and give them more ways to help grow the business, from investing thousands in exchange for equity to contributing $20 in exchange for a first-run product or other reward.

Popularly known as bootstrapping, it is an ideal plan of action when it is hard to convince others of your business idea and vision. Often investors ask for traction before making an investment, the initial round of self-funding allows you to prove the feasibility of your idea and build confidence in the investors for a further round of funding.

Bootstrapping is a great idea for startup funding especially if the initial business requirement is small. It also gives you the freedom of being your own boss. You’re not answerable to anyone and it allows you to keep an eye on the revenue earnings as well.

Venture capital is financing that’s invested in startups and small businesses that are usually high risk, but also have the potential for exponential growth. The goal of a venture capital investment is a very high return for the venture capital firm, usually in the form of an acquisition of the startup or an IPO.

Venture capital is a great option for startups that are looking to scale big — and quickly. Because the investments are fairly large, your startup has to be prepared to take that money and grow.

Angel investors are typically high net worth individuals who look to put relatively small amounts of money into startups, typically ranging from a few thousand dollars to as much as a million dollars.

Angels are often one of the more accessible forms of early-stage capital for an entrepreneur and as such are a critical part of the equity fundraising ecosystem. The biggest benefit to working with an angel investor is that they can usually make an investment decision on their own. Not having to manage a partnership or corporate hierarchy of decision-making allows the angel investor to make bets that they feel comfortable with personally. Often this is what an entrepreneur needs early in their startup’s development.

Small business loans are a more traditional way of getting startup capital, which means they may be easier for some startups to get than venture capital, which can be a long and arduous process. They’re a great option for startups that already have some momentum and — even better — some income coming in. That’s because while venture capitalists are all about taking big risks for the potential of big rewards, traditional banking institutions are more careful with their funds. And unlike taking angel investment or VC money, taking out a small business loan means retaining full ownership of your startup.

We are specialized digital marketing and consultancy services which help in business Start-up, Registration, License and Compliance.